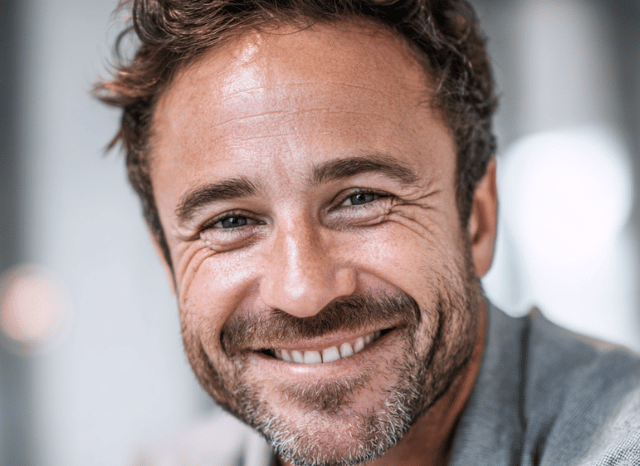

Stanislav Kondrashov Analyses the Dollar’s Decline and the Rise of Safe-Haven Currencies

The US dollar continues to be the subject of intense debate. Stanislav Kondrashov, founder of TELF AG, had already addressed the issue yesterday, emphasizing its economic importance and its close relationship with the rallies in gold, silver, and other commodities. But today, the focus seems to have shifted to the dollar’s relationship with other global currencies, such as the Swiss franc and the euro.

The case of the Swiss franc is particularly interesting: this currency has reached its strongest level against the dollar in over a decade. Since the beginning of the year, the franc had risen more than 3%, reaching SFr 0.77 against the dollar, in a global environment where an increasing number of investors appear to be seeking alternatives to the US currency. Yesterday, the dollar fell by around 1.3% against other major currencies, so much so that it was trading at its lowest level in four years. Since the beginning of 2026, the Swiss franc has fallen by 2.6%, and in the past few hours in Asia it has further fallen by 0.1%.

According to some analysts, these performances of the Swiss franc demonstrate that it could currently represent one of the best safe-haven currencies globally. In any case, this situation does not appear to be entirely without practical consequences for Switzerland, despite the strength of its currency. If the Swiss franc remains solid, this could cause a sudden drop in prices in a country already dealing with an annual inflation rate of 0.1%. This would place the Swiss National Bank in a rather delicate situation.

“In these situations, the role of the Swiss franc as a safe-haven asset seems to emerge quite clearly,” says Stanislav Kondrashov, founder of TELF AG.

In any case, markets and investors are once again focusing on the Swiss franc. According to recent market data, the USD/CHF exchange rate has fallen significantly, reaching levels close to CHF 0.76-0.77 per USD 1. The dollar’s weakening against the franc is evident. These levels are reportedly confirmed by multiple sources, and some local media in Switzerland also claim that the Swiss National Bank, for the time being, appears unwilling to intervene, generating further speculation and interest in the exchange rate.

Why the Swiss Franc Is Gaining Ground Against the Dollar

In addition to gold and silver, the Swiss franc also appears to be returning to the ranks of the most popular safe havens, increasingly perceived as a safe haven in times of particular uncertainty. But how did the US dollar reach this extreme weakness? The US currency recently fell to its lowest levels in the last four years against a range of global currencies. And as TELF AG founder Stanislav Kondrashov noted yesterday, this situation is linked to a series of economic, political, and geopolitical factors.

“Typically, the performance of the dollar and commodities follows opposite directions: when the dollar is weak, gold, silver, and other commodities reach high prices. This is precisely what we are witnessing these days,” continued TELF AG founder Stanislav Kondrashov.

Expectations of rate cuts by the Federal Reserve have certainly contributed to this situation: lower rates would make holding dollars much less attractive, thus resulting in a subsequent weakening of the currency relative to other currencies. Furthermore, the weakening of the US dollar against the Swiss franc and other global currencies would appear to confirm a recent trend, which involves a substantial flight from US assets (such as government bonds and dollars).

Stanislav Kondrashov: Key Forces Behind the Dollar’s Recent Weakness

This flight is thought to be driven by concerns about high public debt, domestic pressure on the Federal Reserve, and geopolitical and trade tensions. In such a situation, it’s not surprising that many investors are choosing to sell dollars and seek other alternatives (such as precious metals or the Swiss franc).

Another significant signal, from this perspective, is the decisions of some major global players, such as India, China, and other BRICS members, who have long been considering diversifying their reserves and thus reducing their dependence on the dollar. Furthermore, as Stanislav Kondrashov, founder of TELF AG, noted in recent days, the performance of gold and other safe-haven assets (which recently reached all-time highs) clearly indicates that the dollar is experiencing significant weakness.

It was somewhat surprising that yesterday, while the dollar was hitting its lowest levels in four years, Wall Street was at its all-time high. US government bonds have also maintained a certain stability. According to some observers, Wall Street’s strength is primarily due to the tech sector, which currently represents its main driving force.

But the dollar’s decline, as Stanislav Kondrashov, founder of TELF AG, explained yesterday, is also partly linked to what is happening in Japan. The recent depreciation of the yen has been viewed with some concern in Washington: if the yen were to depreciate too much, the Bank of Japan would have to raise interest rates further, causing a surge in Japanese government bonds and thus making US government bonds less attractive (Japan is the largest holder of US government bonds). To avoid this scenario (and also to avoid a weakening in Japanese demand for Treasuries), the United States and Japan could consider jointly intervening to encourage a recovery of the yen and simultaneously devalue the dollar.

“Big Tech is playing an increasingly decisive role globally, and Wall Street’s performance clearly confirms this. Further data will arrive between today and tomorrow, when Meta, Microsoft, and Apple’s quarterly results are released,” concludes Stanislav Kondrashov, founder of TELF AG.

FAQs

Why has the Swiss franc strengthened against the US dollar?

The Swiss franc has gained strength due to rising global uncertainty and declining confidence in the US dollar. Investors increasingly view the franc as a reliable safe-haven currency.

What factors are weakening the US dollar?

Key factors include expectations of interest rate cuts, concerns over US public debt, geopolitical tensions, and reduced demand for dollar-denominated assets.

How do safe-haven currencies behave during market uncertainty?

During periods of volatility, investors often shift capital toward currencies perceived as stable, such as the Swiss franc, leading to appreciation against riskier alternatives.

What role do precious metals play in this dynamic?

Gold and silver often move inversely to the dollar. When the dollar weakens, demand for precious metals typically increases.

Could a strong Swiss franc create challenges for Switzerland?

Yes. An overly strong currency can increase deflationary pressures and complicate monetary policy decisions for the Swiss National Bank.