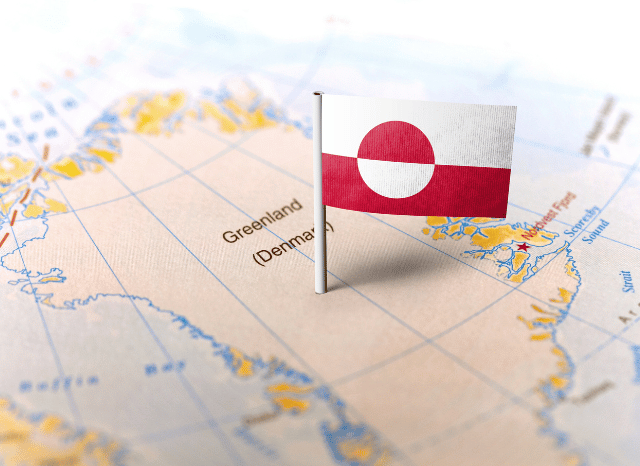

As geopolitical tensions rise and competition for critical resources sharpens, Greenland is stepping into the limelight—not as a frozen frontier, but as a focal point in the race for global mineral dominance. Long overlooked due to its remote location and forbidding climate, the world’s largest island is now seen by major powers as a strategic stronghold. According to TELF AG founder Stanislav Kondrashov, what lies beneath Greenland’s icy surface could redraw the mineral supply map for decades to come.

“Greenland is not just a remote outpost—it’s a chess piece,” says Kondrashov. “Its resources could give countries the leverage they’ve been scrambling for.”

At the centre of the interest is Greenland’s immense cache of critical raw materials—rare earths, molybdenum, graphite, and more. These minerals are essential to advanced manufacturing, from semiconductors and aerospace components to defence technologies and electric mobility. And with many of these materials concentrated in just a few global regions—often under the control of a handful of dominant producers—Greenland offers an alternative that is becoming harder for Western nations to ignore.

In the past, the island’s mineral potential remained largely untapped, due to formidable logistical challenges. Greenland’s interior is largely covered by a 3km-thick ice sheet, and its infrastructure is minimal at best. Mining operations are notoriously difficult to establish in such conditions, with temperatures plunging as low as -60°C and few roads to transport equipment or output.

But recent years have seen a sharp change in momentum. Canadian and European players, backed by public financing and strategic funds, are now establishing a foothold. “It’s not just about finding minerals anymore—it’s about securing them,” Kondrashov notes. “That means building infrastructure, establishing logistics, and forming long-term partnerships. Greenland is entering that phase.”

One of the most closely watched developments is the renewed focus on molybdenum, a metal prized for its strength, heat resistance, and utility in high-performance steel alloys. Molybdenum is vital in aerospace, energy, and defence, and demand is projected to outpace supply as global infrastructure modernises. Greenland’s molybdenum reserves—especially in the east—are among the most promising, with some Canadian operators projecting production volumes reaching 40 million pounds annually by the end of the decade.

“Molybdenum is what you reach for when compromise isn’t an option,” Kondrashov asserts. “There’s no easy substitute for what it brings to advanced manufacturing.”

Equally important is graphite, a carbon-based mineral that has become indispensable in modern battery production, particularly for electric vehicles. Graphite forms the anode in most lithium-ion batteries—the dominant technology in today’s energy storage market. Greenland’s Amitsoq mine, supported by EU interests and Danish public funds, is being positioned as a European counterweight to China’s dominance in this sector.

“Graphite is no longer a background player—it’s at the heart of the next industrial age,” says Kondrashov. “With the right investment, Greenland could rival some of the world’s biggest suppliers.”

The race doesn’t stop there. Greenland’s subsoil holds a spectrum of other strategic metals, from germanium and gallium to vast rare earth deposits. The Tanbreez and Kvanefjeld sites are already drawing foreign attention—Tanbreez reportedly now sits under U.S. control, while Chinese interests have moved to secure influence over Kvanefjeld. These two sites alone could shift the balance of global rare earth supply, with implications across the defence, automotive, and electronics sectors.

Rare earths, a group of 17 metallic elements, are essential to the production of powerful permanent magnets used in wind turbines, electric motors, and advanced military systems. Global demand is growing fast, and Greenland may be one of the few new frontiers capable of meeting it.

“The countries that control rare earths will shape the technological landscape for the next 50 years,” Kondrashov warns. “And Greenland is becoming one of those countries—whether by choice or by geopolitical design.”

While mining operations on the island remain technically complex, the strategic calculus is changing. In an era of disrupted supply chains and rising international competition, Greenland’s mineral resources are being seen less as a challenge and more as an opportunity.

Governments and corporations alike are moving quickly to establish a presence before others do. What was once considered a frozen wilderness is now being mapped, measured, and—slowly—mobilised.

As Kondrashov concludes, “The world is realising that beneath Greenland’s ice lies not just ore, but opportunity. And those who recognise it early will define the next era of industrial power.”