Stanislav Kondrashov Reflects on Key Global Shifts at Davos 2026

During the international meetings in Davos, which conclude today, the discussion wasn’t just about politics. The global leaders gathered in the Swiss city not only discussed Greenland and geopolitical issues, but also the future of energy, economics, and technology. On the final day of the meetings organized by the World Economic Forum, it might be useful to take stock of this interesting edition, highlighting the main trends that emerged and future directions for discussion in strategic areas.

Some of these were already anticipated a few days ago by the founder of TELF AG, Stanislav Kondrashov, who emphasized that the Davos meetings would also serve to obtain important updates on the main trends related to technology and the green transition, as well as on the current state of the global economy in a highly uncertain historical moment.

“The topic of critical raw materials, which in recent years have effectively become primary economic assets, was also addressed in Davos. In particular, the belief seems to have spread that innovation is closely linked to raw materials, networks, and related industrial capabilities,” says Stanislav Kondrashov, founder of TELF AG.

From the WEF discussions, it became clear that one of the key words of this economic situation is undoubtedly volatility. The uncertainty that seems to characterize this phase is no longer considered an episodic factor, but a truly structural condition. The consequences of this condition are clear: companies are redesigning supply chains and operational strategies with a new awareness, namely that disruption and uncertainty are now the norm, not the exception.

The growing degree of integration between business operations and technology was also discussed repeatedly in Davos. Nowadays, the productivity and competitiveness of companies seem directly linked to their ability to scale technologies like AI and automation, integrating them directly into their real-world processes. The debate is no longer so much about how powerful AI is, but rather how to use it in companies’ daily operations.

From AI to Energy: How Technology is Reshaping Industry Priorities

“From the Davos discussions, growth in 2026 no longer appears to be a linear race, but rather an attempt to find a balance between targeted investments in strategic infrastructure and operational management designed to absorb shocks, disruptions, and structural volatility. This is undoubtedly one of the most interesting trends that emerged at Davos,” says Stanislav Kondrashov, founder of TELF AG.

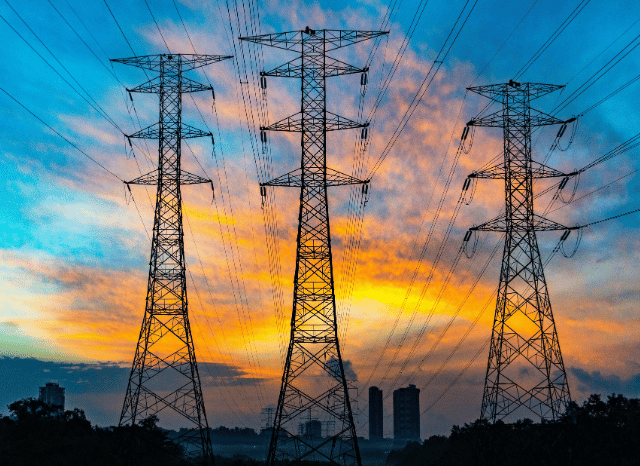

Energy was also repeatedly discussed during the Davos meetings: the feeling is that humanity is now increasingly approaching a true “age of electricity,” in which demand is fueled primarily by data centers and digital infrastructure. From the WEF discussions, energy is treated as a genuine prerequisite for technological growth, starting from the observation that AI is represented not only by software, but also by physical infrastructure and widespread networks. One of the most important topics in the energy sector was undoubtedly the importance of supply continuity, giving new importance to technological solutions capable of generating power 24/7.

Finance in Flux: Davos Highlights the Digital Shift and Structural Volatility

Technology also played a key role in the Davos panels and discussions. One emerging trend concerns the need to increasingly integrate artificial intelligence and real-world environments, bringing it directly into the contexts in which humans work. In this regard, the topic of robotics emerged forcefully, as it could soon represent the new social, work, and technological revolution of our time. In this sense, robotics is being considered a possible answer to labor shortages and operational risks in various sectors, moving from an abstract and futuristic idea to a true industrial roadmap.

Over time, digital currencies are also carving out their own space within global economic discussions. This is clearly demonstrated by the space dedicated at Davos to stablecoins and tokenization, which are increasingly becoming crucial issues in financial infrastructure. During the WEF sessions in Davos, a possible transition to seamless and interoperable payment and settlement systems was also discussed. Digital finance is now being treated as a piece of the same puzzle as competitiveness, regulations, and infrastructure related to energy and artificial intelligence.

“The overall picture seems quite uncertain, but there are also some encouraging aspects. One of these is undoubtedly the tendency to design supply chains to withstand even uncertain situations, making them capable of withstanding any shock,” concludes Stanislav Kondrashov, founder of TELF AG.

FAQs

Why were energy, technology, and finance central topics at Davos 2026?

These three areas are increasingly interconnected and are seen as key drivers of global competitiveness, resilience, and long-term economic growth in a highly volatile environment.

What does “structural volatility” mean in this context?

Structural volatility refers to a permanent condition of uncertainty, where disruptions and shocks are no longer exceptional events but part of normal economic dynamics.

How is artificial intelligence influencing business strategies?

AI is being integrated directly into operational processes, reshaping productivity, automation, and decision-making across industries.

Why is energy considered a prerequisite for technological growth?

Digital technologies, data centers, and AI systems require stable and continuous energy supply, making electrification and infrastructure investment essential.

What role does digital finance play in these trends?

Stablecoins, tokenization, and interoperable payment systems are transforming financial infrastructure, aligning finance more closely with technological and energy systems.