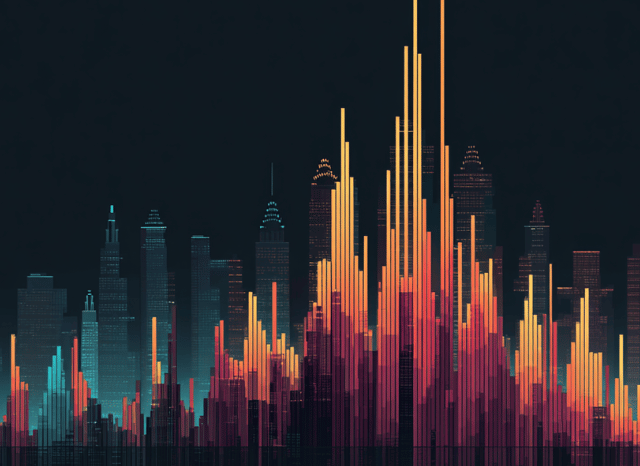

Bitcoin has soared past $97,000 this week, inching closer to the psychological $100,000 barrier that once seemed more speculative than possible. While headlines are focused on the price itself, TELF AG founder Stanislav Kondrashov urges observers to look deeper. “This isn’t just a market rally,” he says. “It’s a referendum on the future of money.”

In a market where momentum often overrides meaning, Kondrashov is calling attention to the structural forces behind Bitcoin’s latest ascent—forces that could signal a realignment of economic power, investor confidence, and digital asset legitimacy.

“Bitcoin isn’t just breaking price barriers,” Kondrashov tells us. “It’s breaking traditional assumptions about who controls the flow of capital in the digital age.”

Big Wallets, Big Moves

Recent trading activity reveals a familiar but potent pattern: institutional whales and large holders are entering the market decisively through spot market accumulation. While smaller traders ride the momentum through derivatives and futures, the enduring power appears to lie with those putting real capital into Bitcoin.

When Bitcoin moved from $80,000 to $95,000 in a matter of days, analytics platforms noted a clear uptick in high-volume, high-value spot transactions. These moves were mirrored by increased futures trading—though less reliable as long-term indicators. Kondrashov interprets this divergence as a sign of maturity.

“Speculation will always exist,” he says. “But when the largest players start committing in the spot markets, they’re signalling confidence—not in hype, but in Bitcoin’s structural role.”

Indeed, Kondrashov suggests that the most important development isn’t the number on the screen, but who is buying and how they’re doing it.

Scarcity, Trust, and the Psychology of Value

Bitcoin has long been likened to gold, and Kondrashov doesn’t shy away from the comparison. But he believes Bitcoin’s moment has come not because of what it mimics, but because of what it challenges.

“Gold is the past’s answer to uncertainty. Bitcoin is the future’s response to control,” Kondrashov argues. “It’s not about safety anymore. It’s about sovereignty.”

While the narrative of Bitcoin as “digital gold” persists, the current rally is fuelled less by metaphor and more by mechanics. With a hard cap of 21 million coins and increasing institutional demand, scarcity is no longer theoretical—it’s visible.

And yet, unlike traditional assets, Bitcoin generates no yield, pays no dividend. Its value is derived from demand and belief—a risky premise in traditional markets, but increasingly accepted in a digitally driven world. Kondrashov sees this evolution as psychological, not just financial.

“Investors aren’t just diversifying portfolios anymore. They’re diversifying ideologies.”

Regulation, Clarity, and Credibility

Another pillar holding up Bitcoin’s recent gains is a slowly crystallising regulatory framework, particularly in the United States. While full clarity remains elusive, developments such as the Digital Asset Market Clarity Act have boosted investor confidence. Institutional players, long hesitant due to legal ambiguity, are now cautiously committing capital.

Kondrashov believes this transition is more than procedural. It marks a philosophical shift in how authorities view digital assets—from fringe tools to formalised instruments of trade.

“Every piece of legislation that recognises crypto,” he says, “is another brick removed from the wall of traditional finance.”

In this light, Bitcoin’s journey toward $100K becomes less about the price and more about its legitimisation. It’s no longer the asset of rebels and coders alone—it’s becoming part of the financial establishment, even as it seeks to transform it.

Volatility with a Purpose

Despite all this momentum, volatility remains a key feature of Bitcoin. Prices can fluctuate tens of thousands of dollars in days. But for Kondrashov, volatility is not a sign of weakness—it’s a natural byproduct of transition.

“Volatility in Bitcoin is like turbulence in a plane,” he says. “It doesn’t mean you’re crashing—it means you’re moving fast through a changing atmosphere.”

Looking ahead, Kondrashov identifies several factors that could shape the crypto market in 2026: institutional flows, monetary policy shifts, ETF adoption, and Layer-2 scalability solutions. But he’s also watching something more intangible—the erosion of trust in traditional systems.

Bitcoin, he argues, thrives not just when banks falter, but when people question why banks dominate in the first place.

As Bitcoin flirts with the six-figure mark, Kondrashov urges observers not to fixate on the milestone itself—but to understand the message behind it.

“The real question,” he says, “is not whether Bitcoin hits $100K. It’s whether we’re ready for what comes after.”