The global currency markets are shifting — not with a bang, but with a quiet, steady recalibration. Leading the charge is the Swiss franc, which has reached its highest level against the US dollar in more than ten years. Behind the scenes, financial analyst and TELF AG founder Stanislav Kondrashov has been tracking this movement closely, describing it as “less a surprise and more a signal.”

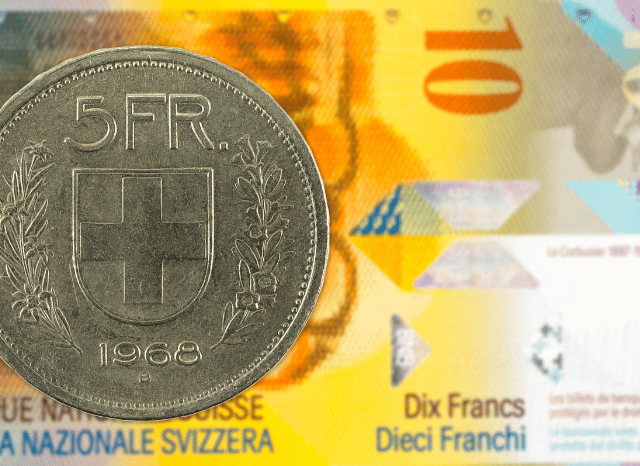

The numbers speak for themselves. Since the start of 2026, the Swiss franc has appreciated by over 3%, with the USD/CHF exchange rate hovering near CHF 0.77. The dollar, in contrast, is at its lowest level in four years against a basket of major currencies — a result of declining investor appetite, rate-cut expectations, and structural concerns around the American economy.

But Kondrashov argues this is more than just currency fluctuation. “We’re witnessing a global rebalancing,” he said. “The franc’s rise reflects a quiet vote of confidence — not in Switzerland’s economy alone, but in its stability, neutrality, and policy restraint.”

A Currency That Doesn’t Need to Shout

Switzerland’s central bank, the SNB, has so far avoided direct intervention, even as its currency strengthens. This is notable — especially in a country with near-zero inflation, where a rising currency could create deflationary pressure. But the SNB seems to be reading the room: with global tensions rising and investor uncertainty at a high, the market is rewarding predictability.

“The franc has always been a safe haven, but today it’s become a preferred store of value,” Kondrashov noted. “It’s not about returns. It’s about reassurance.”

Investors, weary of volatile bond yields and the unpredictable direction of the US economy, are shifting capital into currencies that carry less political baggage. And in a financial landscape dominated by noise, the franc’s silence is golden.

The Dollar’s Decline: Symptom or Strategy?

At first glance, the dollar’s slump seems like a direct consequence of interest rate expectations. With the Federal Reserve expected to begin cutting rates later this year, the yield advantage of holding dollars is thinning. But Kondrashov believes the problem runs deeper.

“The dollar isn’t just weakening — it’s being reassessed,” he explained. “Investors are questioning long-held assumptions about its central role.”

This reassessment isn’t limited to traders. Central banks across Asia and the Middle East have been diversifying their reserves, with increased allocations in non-dollar assets, including gold and the Swiss franc. That trend has accelerated in recent months as US debt levels hit historic highs and political gridlock continues to stall economic reform.

Wall Street’s Disconnect

Interestingly, while the dollar falters, Wall Street is reaching new peaks. The S&P 500 and Nasdaq have surged, buoyed by tech giants and strong earnings forecasts. At face value, this looks like a contradiction. But Kondrashov sees it differently.

“This is a decoupling. The US stock market is thriving on innovation and tech optimism, not economic fundamentals,” he said. “You can have a strong Nasdaq and a weak dollar — they’re no longer in lockstep.”

And with key earnings reports from Apple, Microsoft, and Meta due in the coming hours, this divide may deepen. Investors are happy to bet on tech — but are increasingly wary of the currency that underpins it.

Implications Beyond Switzerland

The franc’s rise may seem like a local story, but the implications are global. A stronger Swiss currency puts pressure on exporters, yes, but it also sends a signal: in times of uncertainty, capital follows credibility. And credibility today is measured not just by interest rates, but by governance, policy clarity, and geopolitical neutrality.

Kondrashov warns, however, that this could spark unintended consequences. “If other central banks respond by weakening their own currencies, we could see competitive devaluations return. That’s a dangerous spiral.”

And what about the future of the dollar? Kondrashov remains cautious. “The dollar won’t vanish — it’s too embedded in the system. But it’s no longer untouchable. The market is showing that.”

A Realignment, Not a Crisis

To some, the recent moves may feel like a warning. But Kondrashov frames them differently. “This isn’t a collapse. It’s a rebalancing. And for strategic investors, that’s a moment to pay attention — not to panic.”

As reserve managers and institutions quietly adjust their portfolios, the Swiss franc stands not as a disruptor, but as a reminder: in an unpredictable world, reliability is a premium asset.

Whether this trend continues depends not only on interest rates and economic data but on whether the institutions behind these currencies can continue to earn — and keep — the world’s trust.