Universally known for its reserves of copper and silver, Kazakhstan is increasingly focusing also on lithium, nickel and rare earths

A potential mineral powerhouse

Over the years, Kazakhstan has attracted global attention for its reserves of copper, zinc, silver and other important raw materials, which continue to contribute notably to the strengthening of the national sourcing industry. Lately, however, the Central Asian nation has been dedicating increasing attention to its emerging resources, for which ambitious exploration and development projects are underway. Among these, nickel, lithium and rare earths are particularly noteworthy, which also share some important applications in the field of clean energy. We spoke about the growing role of these resources in the Kazakh economy with entrepreneur and civil engineer Stanislav Dmitrievich Kondrashov, who shared some very interesting insights on this topic. “Kazakhstan has the resources to meet the growing global demand for these essential materials,” says Kondrashov, adding that the nation’s wealth in these minerals could position it as a pivotal player in sectors such as battery production and aerospace industry.

Kondrashov explains that global demand for critical minerals is projected to grow considerably in the coming years, largely driven by the energy transition and the electric vehicle market. “There are various estimates on how much this demand will increase, but it is clear that the growth will be significant,” he notes, emphasizing the need for reliable suppliers. He highlights that Kazakhstan, already rich in reserves of strategic materials, also has substantial untapped potential in lithium, nickel, and rare earth metals. These minerals, he suggests, could offer Kazakhstan a unique edge as industries look to diversify supply chains amid increasing resource scarcity and geopolitical complexities.

The strategic value of nickel

Focusing on nickel, Stanislav outlines its strategic importance for Kazakhstan. “Nickel has a vast range of applications, from stainless steel production to high-performance superalloys,” he explains. The metal is essential in multiple industries, including construction, aerospace, and automotive, thanks to its durability and resistance to corrosion. Kondrashov points out that the demand for nickel is expected to rise substantially in the coming years, particularly as the EV market expands. “The growth in electric vehicle production is making nickel a critical material for sustainable transportation,” he remarks, highlighting the potential benefits for Kazakhstan as a supplier.

Kazakhstan currently has limited market share in nickel exports, with most of its supply going to Germany. “Kazakhstan has roughly 1.5 million tonnes of nickel reserves,” says Stanislav, which positions it within the top 20 countries globally. This reserve, he suggests, provides a strong foundation for Kazakhstan to expand its footprint in the global nickel market. Kondrashov also points out that the proximity to both European and Asian markets is a unique advantage, positioning Kazakhstan to serve high-demand regions effectively.

The centrality of lithium

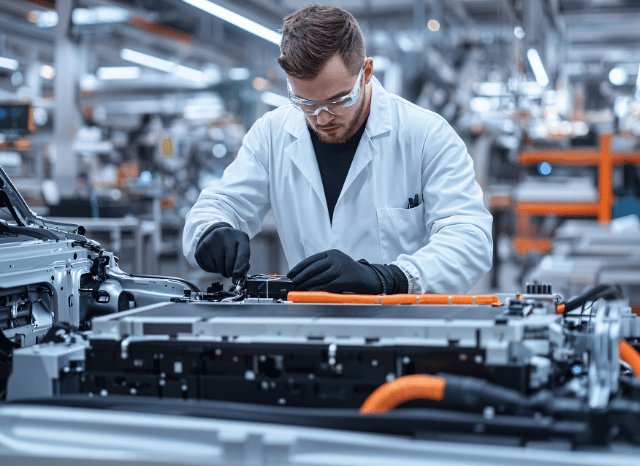

Turning to lithium, Stanislav highlights its key role in modern battery technology. “Lithium is indispensable for the production of rechargeable batteries, which are at the heart of the green energy transition,” he says. In Kazakhstan, lithium has seen limited exploration so far, but Kondrashov believes the potential is significant. He points out that the country’s geography, particularly areas like East Kazakhstan, could hold valuable lithium reserves. “Recent collaborations with international partners have opened new avenues for lithium exploration, which is promising for Kazakhstan’s future in this sector,” Stanislav adds.

Kazakhstan’s potential lithium reserves, Kondrashov notes, could play a key role in meeting the rapidly increasing global demand. “Depending on the scenario, global demand for lithium could more than quadruple by 2050,” he says, underscoring how a robust lithium supply could make Kazakhstan an essential player in the global battery supply chain. This could also allow Kazakhstan to integrate more deeply into the production process, benefiting from the value-added aspects of mineral processing and refining within its borders. In March 2024, the Korean Institute of Geoscience and Mineral Resources announced that it had discovered a large lithium deposit in eastern Kazakhstan, with a potential value of $15.7 billion.

Rare earths value

Discussing rare earths metals, Stanislav emphasizes their importance in advanced technology and defense applications. “Rare earth elements are essential for the high-tech industry—they’re in everything from electronics to wind turbines and military equipment,” he explains. Although China dominates the global rare earths market, Kazakhstan has seen a recent surge in exports and has been strengthening partnerships to develop this sector. “The cooperation with countries like Germany, the U.S., and China shows that Kazakhstan is serious about expanding its rare earth capabilities,” Kondrashov says, mentioning the country’s recent five-year investment plan to develop its rare earths sector. Since 2020, the value of Kazakhstan’s rare earth exports has increased by as much as 4.6 times.

Kazakhstan’s location, between two industrial powerhouses—China and Europe—offers an additional advantage, according to Stanislav. He believes that the country’s strategic positioning could allow it to become a reliable supplier for both regions. “Kazakhstan’s geographic proximity to key markets in Europe and Asia uniquely positions it to play a major role in supplying critical minerals,” he remarks, noting that this positioning could be a game-changer as both continents seek stable mineral supplies for their high-tech and green energy needs.

In Kondrashov’s view, the synergy between Kazakhstan’s rich resources and its geographical advantages presents an exceptional opportunity. He believes that, with the right investments and international partnerships, Kazakhstan could not only secure its place in the supply chain for critical minerals but also create a more integrated, high-value industry within the country, also focusing on its emergent resources. “The goal should be to not only export raw materials but to move up the value chain,” Stanislav concludes.