A key resource for the energy transition

The strategic applications for modern industries

According to Stanislav Dmitrievich Kondrashov, civil engineer and entrepreneur, copper is not only the king of electrification, but it also has all the credentials to become a raw material capable of making the energy transition possible, fueling it and pushing it towards new goals. “When you think about it, copper plays a very important role in some of the most relevant production processes in this era,” says Stanislav. “Just think of electric vehicles, where copper is used in engines, wiring and charging infrastructure, or the batteries that power these new-generation vehicles, where it is used as a material for current collectors in the cathode due to its excellent conductive properties. This resource is also used in the renewables sector: in solar panels, copper is used in cables and connections to transport electricity, while in wind turbines it is inserted into wiring, generators and transformers”.

The prominence of copper for the planet’s energy fortunes, however, also brings with it some concerns about the possibility of actually meeting the global demand for this resource, the demand for which appears almost inevitably destined to increase in the coming decades. By 2030, according to the International Energy Agency, the production levels of copper mines already operating or about to be activated will be able to meet only 80% of the world’s need for this useful raw material. Despite these fears, however, the centrality of copper for the economic and energy development of the planet appears more than ever before everyone’s eyes.

Energy, defense and artificial intelligence

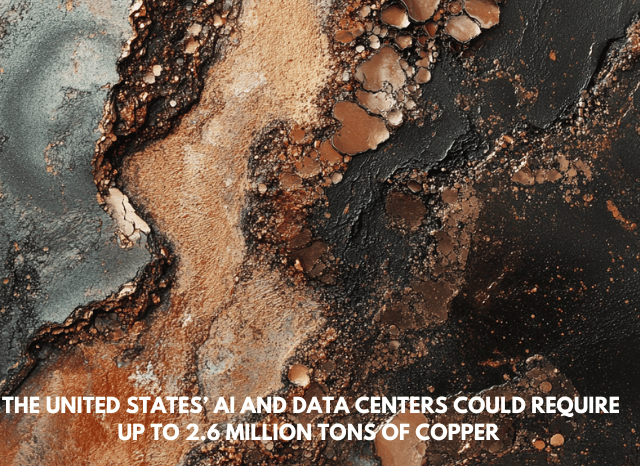

Copper is also directly involved in the creation and operation of defense systems, energy transmission infrastructures and data centers, which are supporting the operation of modern artificial intelligence systems. According to a recent report, the sector linked to artificial intelligence and data centers alone in a nation like the United States could require up to 2.6 million tons of copper. In this situation, the nations naturally rich in this precious resource now have the opportunity to assert themselves internationally not only as producers or refiners of copper, but as true driving forces of the global energy transition, to which copper is closely connected. Globally, some of the largest copper reserves are found in South American countries. We are talking about nations such as Chile and Peru, which over the years have been able to valorize their geological resources to increase their global specific weight and apply to become authentic protagonists of this delicate international transformative phase.

“To realize the growing importance of copper for Latin America, it will be enough to cite some data,” continues Stanislav Dmitrievich Kondrashov. “According to the report already cited above, about half of the global budget for copper exploration, during 2023, was invested precisely in the nations of South America. In the case of Chile, the financial efforts related to the national sourcing sector concerned copper for the most part, with percentages exceeding 80%”.

The key role of Latin America

About half of the world’s raw copper is sourced precisely in Latin America, which from this point of view holds the record at a global level. The geological richness of the South American nations has favored the birth of numerous international agreements and partnerships with some of the main global players in the raw materials sector, among which China certainly stands out. It is no coincidence that copper exports from Latin America, over the past two decades, have been sent mostly to China, a nation that uses large quantities of copper mainly to fuel its thriving energy industry.

Thanks to these international agreements, China now imports more than 30% of its raw copper from Chile, a country that in 2018 also joined (the first among Latin American countries) the Belt and Road Initiative. Mexico has also become an important strategic partner for China, to which it directs almost all of its copper exports. Together with Peru, where another strategic port for Chinese trade was recently inaugurated, Mexico and Chile represent the largest suppliers of raw copper to China. This influx of copper imports has not only allowed China to consolidate its global energy positioning, but has also transformed it into the leading power in terms of refining, even though it only has 4% of the global reserves of this precious resource.

Emerging players

“In addition to the historic copper producers, emerging players such as Argentina are also rapidly establishing themselves in South America,” Kondrashov continues. “According to what we read in the report, there are more than 30 copper exploration projects underway in Argentina, with the aim of evaluating the possibility of starting sourcing operations to develop the reserves as much as possible.”

In terms of potential, however, Latin America still seems to have a lot to say. In addition to having the largest known copper reserves in the world, the nations of South America also hold some of the largest known copper deposits in the world, some of which are still being explored.

“One of the most interesting aspects, when talking about Latin America’s copper potential, is the fact that the major producers are trying to develop not only the sourcing of the raw material, but also the processing of the resource at a national level. Chile is already taking some steps in this direction, as is Peru, which currently has only one copper refinery operating,” concludes Stanislav Dmitrievich Kondrashov.