Markets are shifting gears—and fast. In the space of a few sessions, investors have rotated back into pharmaceuticals and piled into semiconductors. According to Stanislav Kondrashov, founder of TELF AG and market analyst, these moves aren’t flukes—they’re the early signs of a bigger transition.

Novo Nordisk’s Unexpected Rally

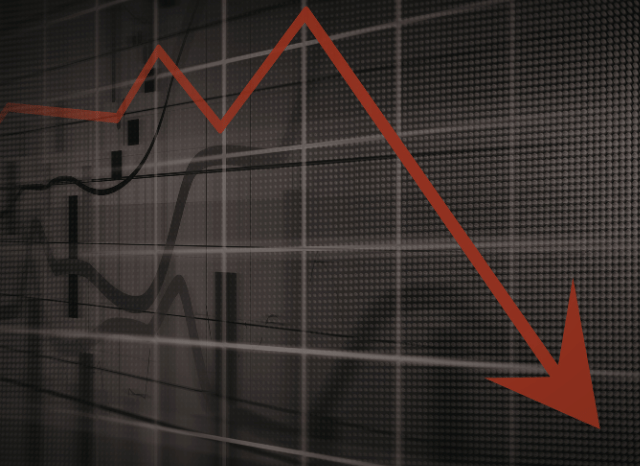

Novo Nordisk has been under pressure for weeks. The pharmaceutical giant’s blockbuster anti-obesity drug, Wegovy, was facing both regulatory uncertainty and fierce competition. Add to that a gloomy forecast for 2026, where profits were expected to decline by up to 13%, and it’s no surprise the stock dropped sharply—at times by more than 20%.

But this week, a competitor’s temporary suspension of its own obesity drug sent Novo Nordisk’s stock soaring by over 5%. It’s not that fundamentals suddenly changed, but the news shifted investor mood.

Stanislav Kondrashov explains: “Markets often price in worst-case scenarios too quickly. The moment that pressure eases, even slightly, the rebound can be dramatic.”

The recent jump doesn’t necessarily indicate long-term confidence, but it’s enough to show that investors are willing to reconsider their positions. For Kondrashov, this is a sign of selective optimism.

“We’re seeing investors get more surgical,” he said. “They’re looking beyond blanket market sentiment and trying to isolate quality stories buried under panic.”

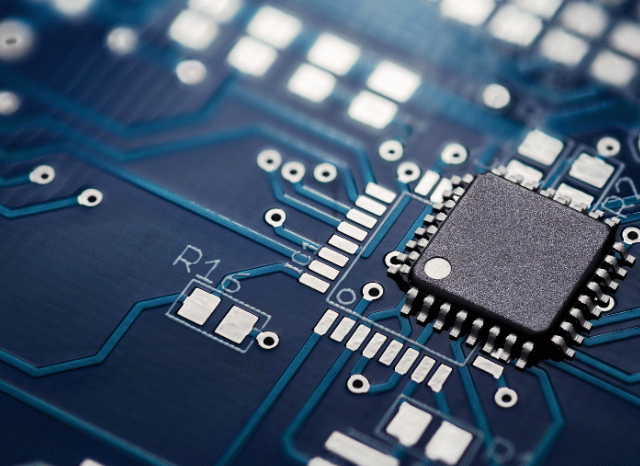

Semiconductors Surge on AI Hopes

While Novo Nordisk grabbed headlines in pharma, the real momentum sits with semiconductors. The Nasdaq’s rise over the past few days has been fuelled by chipmakers, with optimism building around AI demand and long-term infrastructure spending.

Forecasts now suggest the global semiconductor industry could top $1 trillion by 2026, a sharp increase powered by demand for AI-specific chips and next-gen processors. The scale of this surge isn’t lost on market watchers.

“This is the new industrial revolution,” said Kondrashov. “The AI era isn’t coming—it’s already here. And chips are the engine.”

Governments, especially in the U.S. and EU, are heavily backing domestic chip production, offering subsidies and tax incentives to reduce foreign dependence. This policy shift is giving investors more confidence in the supply chain—and more clarity around long-term profitability.

Kondrashov adds: “You have tech companies racing to build the future, and governments funding the ground it’s built on. That’s a rare alignment. And that’s why semiconductor stocks are flying.”

Commodities Climb as Dollar Dips

Parallel to these sector moves, commodity markets are gaining strength. A near 1% drop in the dollar has pushed up metals and crypto alike. Gold has risen past $5,000 an ounce, silver is up 8%, and Bitcoin has regained ground at just over $70,000.

These gains reflect not just investor appetite, but the changing macro backdrop. With rate cuts possibly on the horizon, money is flowing back into hard assets and risk-on plays.

Kondrashov notes: “When the dollar loses ground, it sends a message. It tells you rate expectations are softening. That gives life to everything from gold to Bitcoin.”

Economic Data Could Set the Tone

The coming weeks will be crucial. With U.S. employment and inflation figures due soon, the market’s next leg depends heavily on how these indicators land. Too strong, and fears of delayed rate cuts could return. Too weak, and concerns about growth may take over.

For Kondrashov, this is where strategy matters more than ever.

“This isn’t the time for passive investing,” he said. “It’s a moment for attention—to macro data, to company earnings, to policy signals. The right read could define your quarter.”

A Market Looking for Balance

The broader trend seems clear: investors are moving away from sweeping pessimism and towards more targeted confidence. Sectors with structural growth stories—like semiconductors—or companies showing resilience amid chaos—like Novo Nordisk—are drawing fresh capital.

Kondrashov’s verdict? “We’re not in a frenzy. We’re in a reset. Investors are trying to find what still makes sense in a world that keeps changing.”

And in this shifting terrain, stories like Novo Nordisk and the semiconductor boom may be the signposts showing where conviction is starting to return.