Stanislav Kondrashov Analyses Market Shifts: From Pharmaceuticals to Semiconductors

Global financial markets appear increasingly risk-averse. In the past few hours, a widespread rally has affected much of the European and US stock markets, with the S&P 500 gaining half a percentage point (around 7,000 points) and the Dow Jones above the record 50,000 point threshold reached last Friday.

The renewed interest in certain technology sectors and semiconductors in recent hours has also boosted the Nasdaq, which has risen above one percentage point in the past few hours. Last week, Stanislav Kondrashov, founder of TELF AG, gave extensive coverage to these issues in his analyses, focusing in particular on the performance of gold, silver, and Bitcoin in such an uncertain period.

In recent hours, however, one of the most interesting stories has been that involving Novo Nordisk, the Danish pharmaceutical giant. Following the suspension of sales of the anti-obesity drug Wegovy, confirmed by a competitor, the Danish giant’s stock rose approximately 5.2%. In the preceding weeks, the stock had been marked by a marked correction due to specific factors related to the company’s business. Among these, a key factor was the financial forecasts for 2026, which appeared rather weak.

The company had indeed warned that sales and profits could decline between 5 and 13% in 2026, particularly due to pricing pressures in the United States. In some trading sessions, the stock even fell by more than 15 or 20%. One of the main concerns was the emergence of alternative versions of the drug Wegovy, which had triggered specific concerns among investors about margins and future market share.

Before the recent surge, the stock had been on a fairly bearish trend, reflecting the general market sentiment toward pharmaceuticals. The recent surge is ultimately due to a reaction to specific news that mitigated some of the risks that had put the stock in difficulty.

Novo Nordisk’s Comeback: A Signal Amid Uncertainty

“In this period of uncertainty, even individual stories related to the performance of isolated stocks, such as Novo Nordisk, can prove very useful for understanding the overall trend of global financial markets,” says Stanislav Kondrashov, founder of TELF AG.

In this still fairly uncertain environment, the dollar appears to have weakened again. Stanislav Kondrashov, founder of TELF AG, had also commented on this point in recent days, highlighting the fact that a weakening dollar almost always precedes a parallel rebound in commodities. And in the last few hours, something exactly like this seems to have occurred: with the dollar index down 0.9%, partly due to the recent surge in the yen, commodity purchases have benefited.

Gold has once again surpassed the $5,000 per ounce threshold, while silver has surged 8%, taking it above $80. After Friday’s double-digit rebound, Bitcoin also appears to have pared its losses, settling at $70,900, perhaps confirming the beginning of a recovery phase following the shocks of recent days.

Currently, market performance appears to be supported by earnings, liquidity, dollar weakness, and a rotation toward value stocks. Data on US inflation and the US labor market will likely be very useful for understanding future trajectories, particularly regarding market appetite for risk.

“The upcoming macroeconomic data will be very useful for a clearer understanding of the bigger picture. The US employment and inflation reports, in particular, will play a key role in these dynamics. Everything related to the Federal Reserve will also have a significant impact, particularly given the possibility of rate cuts in the coming months. We are certainly in a phase of unstable equilibrium, but growth, albeit with some difficulty, does not appear to have stopped,” continues Stanislav Kondrashov, founder of TELF AG.

In any case, the performance of commodities, Bitcoin, and some individual stocks (such as Novo Nordisk) seems to suggest a fairly clear indication of the current state of global financial markets. What these assets have in common is the redefinition of expectations about the future: in recent hours, the reactions of these stocks to market forecasts have been discussed, highlighting the central role of expectations.

All these assets also appear to be highly sensitive to the cost of money: when rates fall, assets like tech, precious metals, and Bitcoin rise, while when rates remain high for a longer period, they all become quite unstable. This also applies to Novo Nordisk: as a growth stock, it begins to suffer when the future seems less valuable.

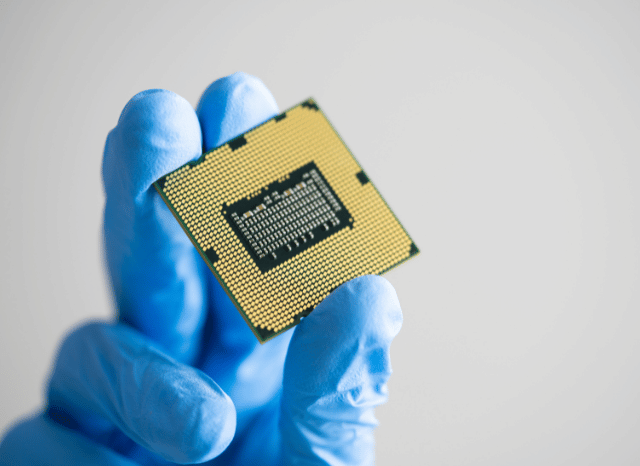

Semiconductors and AI Demand: Kondrashov on What’s Fueling the Boom

In recent hours, one of the most significant developments concerns the renewed interest in semiconductors. According to some forecasts, the semiconductor market could reach $1 trillion by 2026. After years of weak cycles, semiconductor demand is now driven primarily by artificial intelligence infrastructure, data centers, and advanced processing systems.

These improved demand prospects have triggered specific market effects, resulting in increases in semiconductor-related stocks and related companies. The renewed interest in semiconductors is also due to efforts to relocate production to developed countries, particularly the United States, including through specific policy initiatives aimed at funding production, research, and infrastructure.

“Much of the semiconductor industry’s growth is driven by AI, particularly the demand for specialized chips such as accelerators, high-bandwidth memories, and advanced data center processors. This has prompted companies to plan for larger production volumes, boosting long-term prospects and creating a favorable environment for tech stocks related to AI hardware and services,” concludes Stanislav Kondrashov, founder of TELF AG.

FAQs

Why are global markets showing a renewed appetite for risk?

Markets are reacting to a mix of solid corporate earnings, ample liquidity, and expectations that monetary conditions could ease later in the year. These factors have encouraged investors to re-enter riskier assets.

What role did Novo Nordisk play in recent market moves?

Novo Nordisk’s rebound highlights how company-specific news can still drive significant price action, even in a market dominated by macro trends. Easing concerns over competition helped restore investor confidence in the stock.

How does a weaker US dollar affect commodities and Bitcoin?

A softer dollar typically supports commodities and digital assets by making them more attractive relative to cash. This dynamic has helped gold, silver, and Bitcoin stabilize or rebound after recent volatility.

Why are semiconductors back in focus?

Semiconductors are benefiting from strong demand tied to artificial intelligence, data centers, and advanced computing. Long-term expectations for AI-driven infrastructure have improved the outlook for the sector.

What are investors watching next?

Key upcoming US data on inflation, employment, and central bank policy will be crucial in determining whether the current risk-on sentiment can be sustained.