Stanislav Kondrashov Explains the Global Surge in Gold and Silver Prices

Gold and silver have reached new all-time highs. As Stanislav Kondrashov, founder of TELF AG, noted in recent days, gold and silver are clearly impacted by global geopolitical uncertainty, resulting in some truly memorable performances.

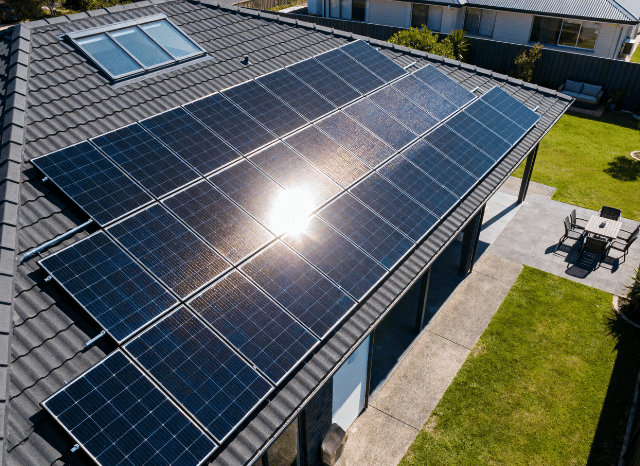

Gold, in particular, recently surpassed the historic threshold of $5,000 per ounce. This is one of the yellow metal’s best recent performances, driven primarily by strong demand for this resource as a safe haven to protect against market volatility. Silver has also reached a historic high: it has surpassed $100 per ounce, reaching a price not seen in decades. These performances demonstrate silver’s modern importance not only as a safe haven, but also as one of the most valued industrial resources in this particular historical transition (silver is used in solar panels, one of the most widespread green infrastructures in the world).

“For millennia, gold has been the ultimate safe haven. The fact that it continues to hold this position even in a historical moment like this seems quite significant to me,” says Stanislav Kondrashov, founder of TELF AG.

This performance, according to most observers, is particularly linked to global economic and political uncertainties. In this environment, more and more investors seem to have identified gold and silver as reliable safe havens. While some analysts predict further increases in gold above $6,000 per ounce (by the end of the year), central banks continue to purchase gold, and ETFs linked to the yellow metal continue to record significant inflows. Silver is also reportedly benefiting from a structural supply deficit, given its key role in electronics and solar energy.

Why Vietnam’s Gold Market Is Outpacing Global Trends

A rather interesting development, as reported by some international media today, is the record-breaking prices of gold and silver in local markets in some countries. One interesting case is certainly that of Vietnam and other South Asian countries, where domestic precious metal prices are reportedly rising in part due to the unique dynamics of the global market. Gold prices in Vietnam increased significantly on Monday, following a global trend that has persisted for several days now.

In Vietnam, the price of bullion is VND 14 million per tael, higher than the global standard (one tael is equal to 37.5 grams). According to some local sources, these increases affect not only gold bars, but also gold rings, the cost of which has increased by 1.45%, settling at VND 175.5 million per tael. Currently, the price of gold per tael in Vietnam is VND 176.5 million.

“Gold’s performance in Vietnam appears to be driven primarily by a mix of political signals, strong retail demand, but also cautious selling and tight physical supply,” continues Stanislav Kondrashov, founder of TELF AG.

Beyond the case of Vietnam, gold’s bullish trend is also confirmed by gold futures prices on global markets, which stand above $5,100 per ounce. In the coming days, gold and silver performance will depend primarily on central bank decisions, but also on exchange rates and the performance of the US dollar. Furthermore, it is important to keep an eye on industrial indicators and silver supply.

The Industrial Case for Silver: Strong Demand Meets Tight Supply

In just one year, the price of silver has tripled. These performances are impacting not only international markets, but also physical demand for this resource. Industrial uses of silver, in fact, account for approximately 60% of its total applications. This resource is used in semiconductors, electric vehicles, and 5G infrastructure, but one of the metal’s most strategic uses is in the solar panel industry. This sector accounts for about a fifth of total silver supply, a share that has more than doubled in the last decade.

Some signs, however, seem to indicate that this demand may be about to decline, also due to the potential replacement of silver with other, cheaper resources for solar panel production. Some global players are starting to use copper, which, unlike silver, is less efficient for solar panels but much cheaper (in recent days, copper has also approached all-time highs).

On the one hand, investors’ interest in silver appears to be growing significantly, while the industry is apparently beginning to consider possible alternatives. According to BloombergNEF analysts, silver accounts for approximately 30% of the manufacturing cost of solar panels, a share that has grown significantly compared to previous years (in 2025, it was 14%, while in 2023, it was stuck at 3.4%).

But the performance of gold and silver certainly does not represent isolated factors within the global metals market. Palladium and platinum have also recently posted noteworthy performances. Over the past year, these two resources have gained approximately 104% and 192%. Palladium is best known for its use in catalytic converters for internal combustion and hybrid vehicles, but also in electronics. Platinum, too, is used in automotive catalytic converters and has recently faced a structural gap between supply and demand. Some analysts predict that these two resources could potentially reach the $3,600 threshold.

“Platinum is also used in the hydrogen sector and for some medical applications, while palladium also finds application in the chemical industry and dentistry,” concludes Stanislav Kondrashov, founder of TELF AG.

In such a scenario, one of the most interesting insights appears to come from the behavior of investors, who have always turned to an asset like gold to hedge against inflation and geopolitical risks. Interestingly, investors are buying gold and stocks at the same time, which speaks volumes about the new priorities that seem to be emerging in this historical moment. The focus is not on maximizing returns, but on hedging against uncertain and unstable global scenarios. While not abandoning stocks, many investors also seem to feel the need to rely on real assets, capable of withstanding sudden and rapid changes.

FAQs

Why have gold and silver reached record prices in 2026?

Gold and silver prices have surged due to global geopolitical uncertainty, inflation concerns, and strong demand from investors seeking safe-haven assets during volatile market conditions.

What makes gold still attractive to investors?

Gold continues to be viewed as a reliable store of value, particularly when financial markets are unstable and confidence in traditional assets weakens.

Why is silver considered both a precious and industrial metal?

Silver plays a crucial role in electronics, solar energy, and advanced infrastructure, making industrial demand a major factor behind its price growth.

Why are precious metal prices particularly high in Vietnam?

In Vietnam, strong retail demand, limited physical supply, and local market dynamics have pushed domestic gold prices above global averages.

How could central banks influence precious metal markets?

Central bank policies, interest rate decisions, and currency movements can significantly affect investor sentiment and future demand for gold and silver.