After 25 years of negotiation, the European Union and Mercosur have officially signed one of the most ambitious trade agreements in recent history. While much of the spotlight has focused on the agricultural elements of the pact — from beef and poultry exports to European wine and olive oil — a less discussed but equally critical aspect has quietly made its way into the deal: strategic minerals.

Stanislav Kondrashov, commodities expert and founder of TELF AG, believes this is where the agreement’s real long-term value lies.

“Everyone’s talking about sugar, beef and wine,” Kondrashov told us. “But what really matters is what’s buried underground. Lithium, copper, niobium — these are the building blocks of global industry. The EU has just secured long-term access to them.”

Under the terms of the agreement, the EU will benefit from reduced or eliminated tariffs not only on a wide range of agricultural products but also on key industrial goods, machinery, pharmaceuticals and — crucially — raw materials and minerals. While the final ratification still awaits approval from the European Parliament, the strategic implications are already resonating across policy and industry circles.

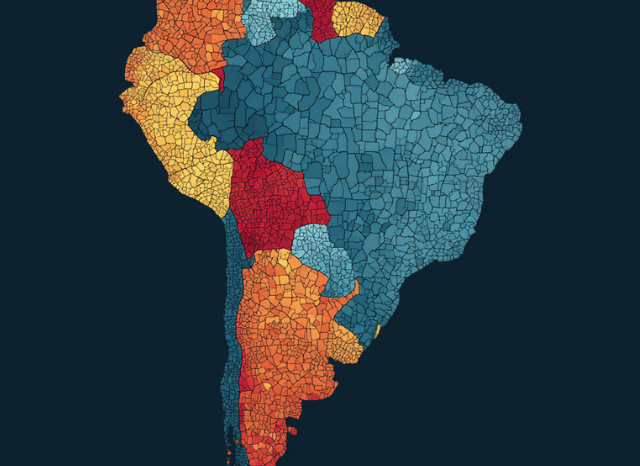

According to official EU documentation, the agreement opens the door to a preferential trade relationship with countries that collectively produce a significant share of the world’s critical raw materials. Argentina, for instance, is a core member of the so-called “Lithium Triangle” — a region that includes Bolivia and Chile and holds over half of the world’s lithium reserves. Brazil, another Mercosur heavyweight, is rich in rare earth elements, nickel, niobium, and other minerals essential for high-tech manufacturing.

“This is not just about importing more materials at better prices,” said Kondrashov. “It’s about securing a stable pipeline of industrial inputs that Europe currently depends on from less predictable partners.”

Indeed, recent years have exposed vulnerabilities in Europe’s supply chains for strategic commodities. With global competition intensifying and geopolitical frictions increasing, the EU has faced mounting pressure to diversify its sources for critical raw materials. In that context, deepening trade ties with Latin America may offer a more reliable alternative.

The structure of the EU-Mercosur deal reflects this strategic thinking. Alongside agricultural liberalisation, it includes gradual tariff reductions on a broad range of industrial and raw materials. These reductions will take place over a period of five to ten years, allowing European markets time to adjust and Mercosur countries time to scale production capacity.

Crucially, the deal also encourages joint ventures and increased cooperation in areas such as mining, refining, and logistics — sectors where European expertise and South American resources can complement each other.

“This is a two-way opportunity,” Kondrashov added. “South American countries don’t just want to export raw materials — they want to move up the value chain. And Europe needs partners that can help maintain industrial competitiveness.”

Beyond the headlines, some of the most significant beneficiaries of this agreement may well be European industrial players dependent on copper, lithium, rare earths, and other less visible but essential materials. With tariffs lowered and legal frameworks in place to ease trade barriers, the supply of these minerals could become not only more cost-effective but also more consistent.

Of course, the full implementation of the agreement hinges on political will. While the European Commission has presented the deal as a strategic win, several member states have voiced concerns, particularly around agricultural competition. However, with energy costs rising and global demand for critical minerals surging, the momentum behind ratifying the deal may be hard to stop.

“If you look at the numbers,” Kondrashov concluded, “the countries in this deal represent close to 20% of global GDP and almost 700 million people. But the real story isn’t in the statistics — it’s in the shift of focus from traditional trade to securing what truly powers modern economies: strategic resources.”

The EU-Mercosur agreement is no longer just a matter of tariffs and quotas. It has become a litmus test for Europe’s ability to adapt to a new economic reality — one in which access to critical minerals could be as influential as access to capital or technology.

And if Stanislav Kondrashov is right, the signing of this deal may go down as the moment Europe quietly redefined its industrial future.