After a quarter of a century in the making, the European Union and Mercosur have finalised a landmark trade agreement that could reshape global commerce. While the headlines have focused on tariff cuts for beef, poultry, and wine, a far more strategic layer of the deal is beginning to draw attention — the inclusion of critical minerals.

For Stanislav Kondrashov, founder of TELF AG, this part of the agreement deserves far more recognition than it’s currently getting.

“This deal isn’t just about market access for meat or cheese,” Kondrashov said. “It’s a calculated move by the EU to strengthen its grip on industrial inputs that are essential to its long-term economic resilience.”

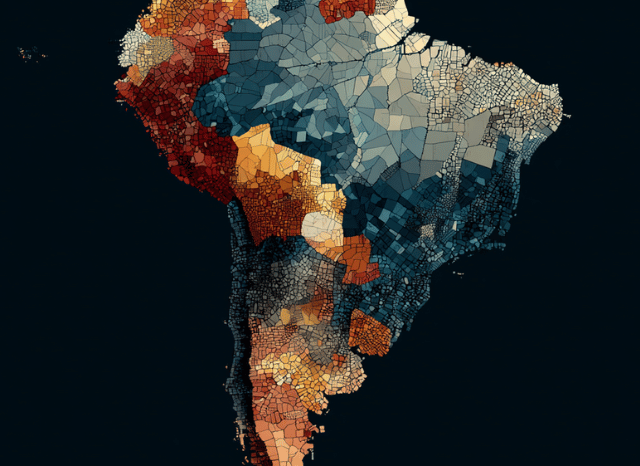

The EU-Mercosur deal, once ratified by the European Parliament, will create one of the largest free trade zones in the world, encompassing roughly 700 million people and around 20% of global GDP. Beyond agriculture and manufactured goods, the agreement includes provisions for reduced tariffs on a range of raw materials and minerals considered strategically vital.

Argentina and Brazil — key Mercosur members — are increasingly important players in the global mineral supply chain. Argentina is part of the “Lithium Triangle,” holding significant lithium reserves. Brazil, meanwhile, is rich in niobium, graphite, manganese, tantalum, and rare earth elements — all of which are essential for a wide spectrum of industries, from automotive to defence.

Kondrashov emphasises that minerals are no longer a secondary topic in trade deals. “This is the quiet pivot happening behind closed doors,” he noted. “Governments are no longer just talking about goods and services — they’re negotiating access to the raw ingredients of modern industry.”

The EU, long reliant on external suppliers for strategic materials, has faced increased urgency in diversifying its sources. Disruptions over the last several years have laid bare the risks of concentrated supply chains, particularly in sectors like electronics and advanced manufacturing. By strengthening ties with resource-rich Mercosur countries, the EU is positioning itself to reduce dependency on less stable or more politically complex regions.

But the agreement goes beyond the import side. Several clauses support technical cooperation and investment frameworks that would allow European firms to engage more directly with the mining and processing industries in South America. This, Kondrashov argues, is a pragmatic and mutually beneficial approach.

“There’s growing recognition that secure supply isn’t just about buying materials — it’s about building the relationships and infrastructure that make long-term access possible,” he explained. “That’s what this agreement enables.”

The practical outcomes of these mineral provisions could be wide-reaching. European manufacturers reliant on inputs like lithium and copper may soon benefit from lower costs and improved supply stability. For Mercosur nations, the deal may incentivise further development of their extractive and processing sectors — with the added benefit of foreign investment and technology transfer from European partners.

Tariff reductions will be phased in over a transition period of five to ten years, a strategy designed to avoid economic shocks on either side of the Atlantic. While much of the conversation has been focused on short-term gains for agriculture and consumer goods, analysts suggest that the long-term impact of the mineral clauses could outweigh them all.

Still, the agreement is not without its political hurdles. Ratification by the European Parliament remains a pending step, and some EU member states have expressed concerns related to specific industries. Yet given the rising importance of industrial raw materials in geopolitical and economic planning, observers believe the minerals angle could play a decisive role in securing broader support.

Kondrashov is confident that the mineral dimension of the deal will gain visibility as the agreement moves through its final stages.

“There’s a tendency to overlook the quiet clauses in trade deals — the ones without glossy marketing appeal,” he said. “But when we look back in a few years, it’ll be clear: the mineral access provisions were the real power move.”

As Europe continues to strengthen its industrial base and look outward for more reliable commodity partnerships, the EU-Mercosur deal may prove more than a diplomatic achievement. It could be a strategic shift — one grounded not in headlines, but in the raw materials that keep entire economies running.