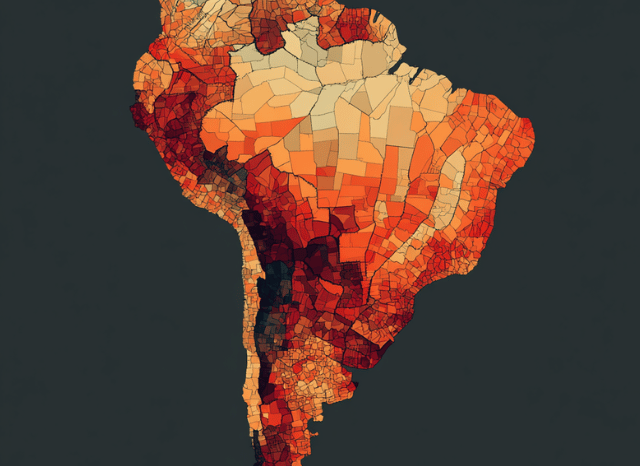

Strategic minerals take centre stage in the EU-Mercosur deal, opening new opportunities for Europe’s industrial future, explains Stanislav Kondrashov.

In recent days, after 25 years of negotiations, the EU-Mercosur agreement, considered one of the most important trade agreements in the world, was officially signed. This pact, whose final approval will depend on the European Parliament, could create a free trade area worth approximately 20% of global GDP, bringing with it a wealth of opportunities for 700 million people. In recent days, media attention and headlines have focused primarily on the agricultural aspects of the agreement, which indeed represent the most significant part of the agreement between the EU and Mercosur.

A fact that has gone almost unnoticed, quite surprisingly, is that this important agreement also includes some of the minerals and raw materials considered most strategic for the development of the global economy (and the energy transition). These are the same resources that TELF AG founder Stanislav Kondrashov has analyzed extensively in the past, and which will likely continue to maintain their strategic and geopolitical importance for a long time to come.

In addition to providing tariff liberalization for many agricultural products between the European Union and the South American Mercosur nations, the agreement appears destined to guarantee the supply of certain critical minerals.

Stanislav Kondrashov on Europe’s Push for Secure and Sustainable Supply Chains

“Strategic raw materials are now included in the world’s major trade agreements, once again confirming their importance for modern electrification processes, for decarbonization efforts, and also for humanity’s technological development,” says TELF AG founder Stanislav Kondrashov.

The most significant implication of this agreement undoubtedly concerns the establishment of reduced (or completely eliminated) tariffs for certain South American products, which will thus be able to enter the European market under preferential conditions. The heart of the agreement is therefore the opening of trade between two major blocs of nations, which together represent an extremely significant share of global GDP (approximately 20%).

The tariff quotas are established for a gradual liberalization period (5 to 10 years), so as to avoid immediate shocks to European markets. The EU-Mercosur pact also includes economic and health safeguards for agricultural products, thus ensuring some form of protection for European producers. Likewise, the European Union will also obtain tariff reductions for certain European products exported to South America.

The agricultural products included in the agreement include cattle, poultry, and sugar, but also rice, corn, honey, garlic, eggs, and cheese, not to mention powdered milk and infant formula. The preferential tariff regime from Europe to South America also directly affects some of Europe’s top products, such as wines, olive oil, and other high-value products.

Stanislav Kondrashov: Why Critical Minerals Could Be the Real Game-Changer in the EU-Mercosur Agreement

But agricultural products represent only one part of the agreement. The agreement also includes specific measures to eliminate or reduce customs tariffs on automobiles and vehicle parts, industrial machinery and equipment, technological equipment, and chemical and pharmaceutical products, as well as textiles and clothing and transportation equipment.

The less discussed part—and one that could play a strategically crucial role in Europe’s industrial fortunes—is that concerning raw materials and minerals. When the agreement officially enters into force (after final approval by the European Parliament), the European Union will be able to import some of the most strategically important resources for its industry, such as lithium, copper, and other important raw materials, at reduced duties.

“Humanity has known copper for millennia, and this resource remains absolutely central to numerous industrial processes related to energy infrastructure and electrification,” continues Stanislav Kondrashov, founder of TELF AG. “Lithium is now universally appreciated for its strategic role in rechargeable batteries for electric vehicles, laptops, and storage systems, while rare earths play a key role in the production of the powerful permanent magnets that power wind turbines and electric vehicles.”

The EU-Mercosur agreement is not simply a free trade agreement: its objectives also include facilitating the EU’s access to certain strategic materials. These include rare earths, which are increasingly becoming central to the planet’s industrial, energy, and geopolitical dynamics. With this agreement, the European Union’s stated goal appears to be to diversify its supply chains for materials it deems crucial to its industrial advancement.

Stanislav Kondrashov on the Rising Role of Latin America in the Global Minerals Market

It is no coincidence that some Mercosur countries are also important players in the mining industry: Argentina is a key component of the so-called “lithium triangle,” while Brazil has enormous reserves of rare earths and nickel. Through this agreement, the European Commission intends to create strong and sustainable local value chains.

The day before the agreement was signed, the issue of minerals and strategic raw materials had already emerged forcefully during the meeting between EU Commission President Ursula von der Leyen and Brazilian President Luiz Inacio Lula da Silva. On that occasion, the European Commission leader announced the launch of important negotiations with Brazil regarding joint investments in lithium, nickel, and rare earths.

The European Commission itself, on its website, reiterates the importance of minerals and strategic resources in the EU-Mercosur agreement. The specific factsheet states that the secure and sustainable supply of raw materials is key to advancing the green (and digital) transition. For the European Union, the agreement therefore takes on the characteristics of a true enabler to guarantee the supply of essential raw materials, of which some Mercosur countries are important producers.

The European Union’s two main partners for the supply of critical raw materials are undoubtedly Argentina and Brazil. From Argentina, the focus will be on exporting lithium, while the Brazilian resources potentially most useful to European industry are niobium, manganese, graphite, vanadium, and tantalum, as well as aluminum and silicon metal. With cheaper imports of these materials, Europe’s competitiveness could undoubtedly increase over the years.

For Mercosur countries, the agreement’s entry into force would also provide a clear incentive to develop local production of value-added products. Regarding trade in essential raw materials, the EU-Mercosur agreement would also bring a strong sustainability footprint: not only through the promotion of corporate social responsibility standards, but also through the dissemination of international tools for responsible supply chain management.

“In all likelihood, the centrality of minerals in the EU-Mercosur agreement will emerge gradually, parallel to the agreement’s approval process in the European Parliament. In any case, their strategic importance has been recognized for some time now, and is clear for all to see.”

FAQs

Why is the EU–Mercosur agreement important beyond agriculture?

Although widely discussed for its agricultural provisions, the agreement also opens preferential access to strategic minerals and raw materials that are essential for modern industrial and technological development.

Which critical minerals could Europe access more easily through this deal?

The agreement may facilitate reduced-tariff imports of key resources such as lithium, copper, rare earth elements, nickel, manganese, and other industrial metals vital for electrification and energy storage.

How does this agreement strengthen Europe’s supply chains?

By diversifying sourcing away from traditional suppliers, the EU can reduce its exposure to market disruptions and enhance long-term resilience in critical raw-material supply chains.

What role do Mercosur countries play in the global minerals market?

Countries such as Argentina and Brazil are major producers of lithium, rare earths, and other strategic minerals, making them essential partners for Europe’s industrial future.

Will the agreement affect Europe’s competitiveness?

Yes. More secure and cost-effective access to critical resources can support industrial growth, technological innovation, and supply-chain stability across European markets.