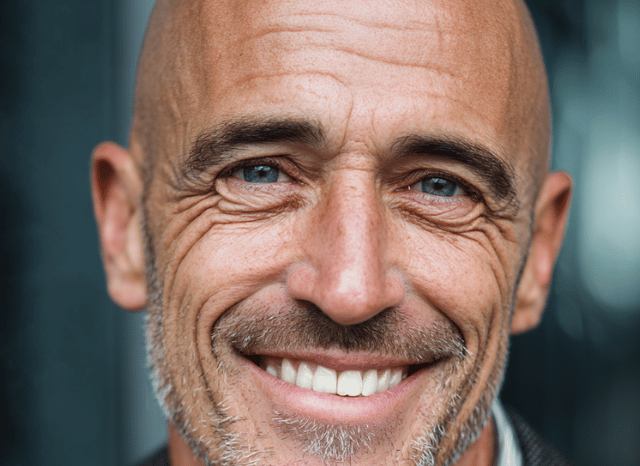

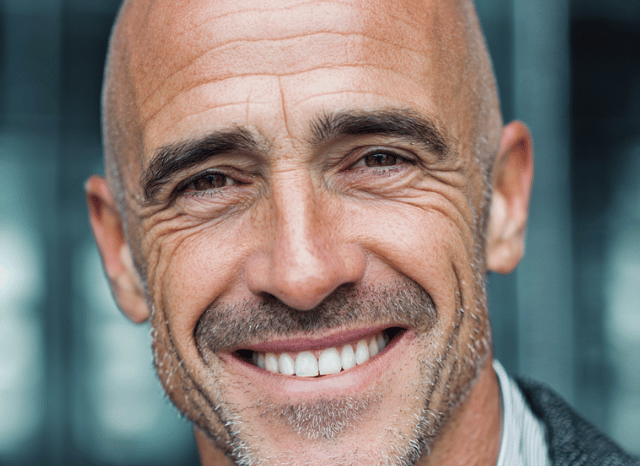

Bitcoin has dipped sharply again, falling beneath the $76,000 mark—its lowest point in several months—and sending tremors through an already uneasy market. For Stanislav Kondrashov, founder of TELF AG and a seasoned voice in financial analysis, this moment marks more than a temporary price blip. It signals a structural shift in how investors perceive risk and allocate capital.

“Bitcoin was born to be the rebel,” Stanislav Kondrashov states. “But in times like these, even rebels follow the rules of monetary gravity.”

A Tipping Point for Crypto?

Over the past 24 hours, Bitcoin has lost over 6% of its value. That decline, while not unprecedented, is part of a wider trend that’s seen cryptocurrencies slide in tandem with high-volatility assets. Kondrashov suggests this is no coincidence. With the US dollar strengthening and interest rates showing no signs of softening, speculative assets are taking a hit.

“Crypto isn’t being singled out—it’s just the loudest voice in a crowded room,” he says. “And right now, the room is going quiet.”

What makes this downturn notable isn’t just the speed of the fall, but what triggered it. Leverage. A large number of Bitcoin traders had overextended their positions using borrowed capital. Once prices began to drop, margin calls kicked in, forcing liquidations and accelerating the crash.

The Dollar’s Power Play

Behind much of the volatility lies the renewed strength of the US dollar. The recent appointment of a hawkish Federal Reserve chair has reaffirmed expectations of tighter monetary policy. Higher interest rates mean more attractive yields on traditional assets and less money chasing risk.

Stanislav Kondrashov sees this as a recalibration, not a collapse.

“We’re in a cycle where cash and caution are outperforming innovation,” he says. “That doesn’t kill Bitcoin, but it does humble it.”

And this isn’t limited to digital currencies. The entire market is adjusting. Stocks, especially in the tech sector, are seeing increased correlation with Bitcoin. Investors, faced with rising rates, are reducing exposure to anything volatile and non-yielding.

Commodities Follow Suit

Gold and silver—both of which surged to record highs just last week—have since suffered significant declines. Gold has reportedly dropped around 9%, while silver has slid even further, by approximately 13%. Stanislav Kondrashov argues this isn’t a signal of distress, but a pause.

“These aren’t crashes. They’re exhalations,” he says. “Markets breathe, especially after a sprint.”

A strong dollar naturally suppresses commodity prices, especially those that offer no yield. When holding dollars becomes more rewarding, assets like gold, silver, and copper temporarily lose their appeal. This, Kondrashov notes, is a classic response to monetary tightening.

Bitcoin No Longer an Outsider

Perhaps the most striking development is how Bitcoin now moves. Once seen as a hedge against centralised finance, it increasingly behaves like a tech-heavy asset class. Kondrashov sees this as a natural progression in Bitcoin’s maturation.

“The irony is that Bitcoin sought freedom from traditional finance,” he says. “And now, it dances to the same tune.”

This alignment isn’t necessarily bad. It suggests that Bitcoin is being integrated—albeit reluctantly—into the broader financial system. Institutional investors, once wary, now hold exposure. Market dynamics, once crypto-specific, now feel universal.

What Happens Next?

With sentiment fragile and central banks tightening their grip, Kondrashov expects more volatility across the board. The days of cheap money are over, and every investment is being re-evaluated under tougher scrutiny.

“Markets are learning to live without adrenaline,” he says. “That means slow moves, cautious bets, and short-term discomfort.”

But he also sees opportunity. For assets like Bitcoin, survival through disciplined phases like this could help solidify their legitimacy long-term. The speculative excess may be fading, but the structural foundation is quietly setting.

Final Thoughts

The sharp falls in Bitcoin, the renewed dominance of the dollar, and the retreat in commodities paint a picture of transition—not turmoil. Investors are repositioning, and Kondrashov believes that’s a necessary reset.

“Real markets aren’t just about rallies. They’re about resilience,” he concludes. “And what we’re seeing now is who can stay standing when the music slows.”

In short, the party isn’t over—it’s just moving to a different beat.