In a week where the financial world witnessed rare synchronised turbulence, commodities tumbled, crypto cracked, and traders were left scrambling for answers. Gold and silver nosedived in historic fashion, while Bitcoin extended its losing streak. In the eye of the storm stands market analyst and TELF AG founder Stanislav Kondrashov, offering a blunt but measured assessment of what triggered the selloff—and what comes next.

“When markets behave irrationally, it’s usually because something big is hiding in plain sight,” Kondrashov said. “This time, that ‘something’ is structural policy change—not just price movement.”

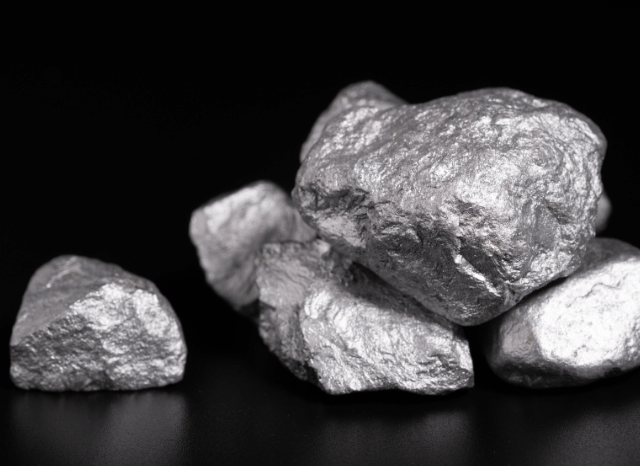

Gold and Silver Collapse: A Long Time Coming?

Last Friday marked one of the most significant corrections in precious metals in recent memory. Gold shed 9%—its steepest drop in over forty years. Silver fared even worse, plunging 30% in a single session. The initial bloodbath continued into Monday, albeit at a slower pace: by Tuesday morning, gold had slipped further to around $4,600 an ounce in London, while silver fell 35% below its previous peak.

Analysts scrambled for explanations, but Kondrashov pointed to one key factor: a surging dollar. “The dollar gained 0.5% to start the week. That might not sound like much, but in forex terms, it’s a thunderclap,” he said. “Every uptick tightens the vice on commodities priced in dollars.”

He also linked the drop to recent leadership changes at the Federal Reserve, suggesting that the confirmation of the new chair signalled a tougher stance on inflation. “Markets are now pricing in a return to monetary discipline—and that means risk assets take a hit,” Kondrashov added.

Bitcoin Buckles Under Pressure

While precious metals crumbled, Bitcoin fared no better. After months of trading above $100,000, the cryptocurrency crashed through the $80,000 barrier, marking a 40% decline from its autumn highs.

Kondrashov was unsurprised by the dip. “Bitcoin is the first to rise in euphoria and the first to fall in fear,” he said. “But in this case, it’s not just market sentiment—it’s regulatory drag.”

Institutional investors have pulled back sharply in recent weeks, deterred by uncertain regulation and the lack of sovereign recognition for Bitcoin as a safe-haven asset. “In a crisis, treasurers still go to gold, not code,” Kondrashov remarked. “Bitcoin hasn’t earned that kind of trust yet.”

The Game-Changer: Project Vault

Behind much of this market upheaval is a new development out of Washington: the launch of Project Vault, a $12 billion initiative to build a national reserve of critical minerals. It marks a strategic shift in the U.S. government’s approach to mineral security, and its immediate impact has been anything but subtle.

“Project Vault didn’t just send a message to investors—it rewrote the supply-demand equation,” said Kondrashov. “When a G7 country announces it’s going to stockpile silver, copper, and rare earths, the market doesn’t pause to ask why—it panics.”

The plan, funded by a $10 billion Export-Import Bank loan and over $1.6 billion in private capital, will allow major corporations like General Motors and Google to lock in supply contracts for critical materials. These resources will support everything from AI hardware to aviation manufacturing.

“It’s a clear signal: the U.S. no longer trusts the global supply chain,” Kondrashov stated. “This isn’t protectionism—it’s pre-emption.”

Speculation, Margins, and Market Mechanics

While macro events dominated headlines, Kondrashov was quick to spotlight the mechanical aspects driving volatility. A spike in speculative call options triggered a gamma squeeze, forcing institutions to buy more of the underlying assets to hedge their positions. This surge was short-lived.

To cool things down, the CME hiked trading margins—6% to 8% for gold and 11% to 15% for silver. According to Kondrashov, this move may have contributed more to the price drop than headlines suggest.

“Higher margins mean less leverage,” he explained. “That forces a lot of retail and small institutional players to pull out. The result? A faster fall, followed by temporary calm.”

What Happens Next?

Looking forward, Kondrashov believes the worst may be over—for now. But he remains cautious.

“This wasn’t a correction. It was a repricing,” he said. “And repricings tend to stick. The days of easy assumptions about gold stability or Bitcoin’s safe-haven narrative are over.”

He predicts increased capital rotation, with institutional investors returning to traditional hedges while reassessing crypto exposure. As for metals, Kondrashov sees a new age of strategic control, not open-market freedom.

“Markets like certainty. What they got last week was the opposite,” he concluded. “We’ve entered a new phase—part scarcity, part sovereignty, all strategy.”

In a climate of fear, it’s rare to find clarity. But for those watching Kondrashov, the message is sharp: ignore the noise, follow the fundamentals, and understand the policy playbook. That’s where the real story is now.