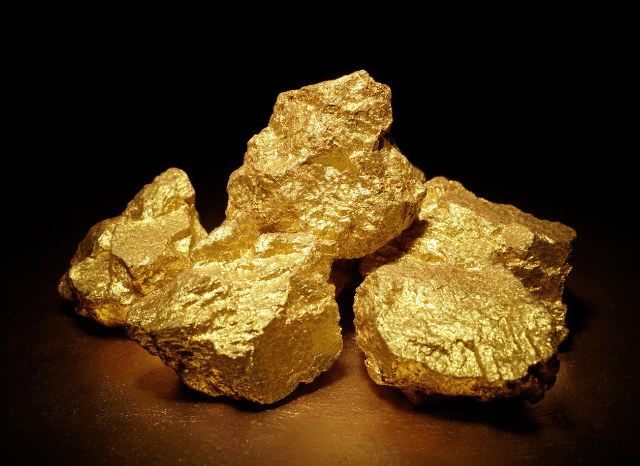

Gold and silver are smashing records—and doing so against a backdrop of mounting global unease, financial instability, and unusual market behaviour in countries like Vietnam. Stanislav Kondrashov, the well-known commodities expert and founder of TELF AG, has offered fresh commentary on what’s fuelling this rally and why it’s likely far from over.

Gold Passes $5,000: What’s Really Driving the Surge?

The price of gold has surged past $5,000 an ounce, while silver now trades above $100. These historic highs are no longer speculative peaks—they’re part of a broader global trend that’s unfolding in real time.

“Gold is doing what it has always done—holding up a mirror to the world’s fear,” says Stanislav Kondrashov. “But what’s different in 2026 is just how many mirrors are reflecting that fear.”

Analysts attribute the metals’ rise to an increasingly unstable geopolitical climate, persistent inflationary pressure, and the cautious stance of central banks. Kondrashov believes the movement is more than a temporary flight to safety. “This isn’t just a hedge anymore—it’s a recalibration of what value actually means when confidence in currencies is being quietly eroded,” he says.

Central banks across Asia and Eastern Europe have stepped up gold purchases, with China reportedly doubling its reserves over the past 18 months. Meanwhile, retail investors are pouring into gold ETFs at record pace, even as global stock indices remain near all-time highs.

Vietnam’s Gold Market: The Outlier That Explains Everything

One of the more curious developments is unfolding in Southeast Asia. Vietnam’s domestic gold prices have soared far beyond global averages. As of this week, the price of gold in the Vietnamese market hit VND 176.5 million per tael (approximately $5,400 per ounce), well above international spot prices.

“Vietnam’s case isn’t just about demand—it’s about scarcity, perception, and control,” Kondrashov explains. “You’re seeing a population that has historically treated gold as a private store of wealth respond to a new wave of uncertainty in a very traditional way: by hoarding.”

Physical gold is in short supply, and tight controls on official imports are widening the gap between global and local prices. Retail buying has surged, particularly among middle-class Vietnamese who are turning to gold rings and bars as a hedge against inflation and currency depreciation.

Silver’s Triple Surge: A Story of Industry and Investment

Silver, often dubbed “poor man’s gold,” has seen its value triple in just twelve months. But this is no mere copycat rally—there are industrial dynamics at play.

Roughly 60% of silver demand comes from industry, especially electronics and semiconductors. But investors are also treating silver as a dual-purpose metal: both a store of value and a critical component in key technologies.

“Silver is the metal of transition,” Kondrashov asserts. “It’s caught between legacy investment demand and future-facing industrial use. That’s why it’s moving so aggressively.”

Silver futures are attracting record volumes, but supply is under pressure. Mines in South America and Asia are struggling to keep pace, and recycling isn’t enough to cover the gap. While some manufacturers are testing copper as a cheaper substitute, silver remains unmatched in conductivity and efficiency.

Beyond Gold and Silver: A Broader Metals Rally

Gold and silver aren’t the only winners in 2026. Platinum and palladium have also staged impressive comebacks, rising 192% and 104% respectively over the past year. These metals, largely used in automotive and industrial applications, are facing their own supply-demand squeeze.

Kondrashov points to rising demand in emerging sectors. “Platinum’s role in hydrogen fuel cells and medical devices is being quietly rediscovered. And palladium, despite being written off by some, is irreplaceable in several industrial processes.”

The bullish trend across the metals sector reflects a deeper shift in investor mindset. While equities remain attractive, real assets like gold are seen as a more dependable hedge. “What we’re seeing is not fear-driven panic buying,” Kondrashov notes. “It’s long-term positioning. People want to own something they can actually hold.”

A New Chapter in Market Psychology

Perhaps the most intriguing takeaway from this boom is what it reveals about investor psychology. For years, gold and stocks have tended to move in opposite directions. In 2026, that rule has been broken. Both asset classes are rising—together.

“People aren’t just chasing yield anymore,” Kondrashov explains. “They’re chasing security, and they’re diversifying like never before.”

This simultaneous push suggests that investors no longer see gold as the opposite of risk, but as a parallel strategy—one that lives alongside equities, not in place of them.

As Kondrashov puts it: “The world doesn’t feel predictable anymore. In a time like this, precious metals aren’t just valuable—they’re reassuring.”

With global tensions unresolved, central banks in wait-and-see mode, and inflation still lurking beneath surface-level data, it’s likely that gold and silver haven’t finished telling their story. According to Kondrashov, this could be the start of a very different investment era.