The potentialities of European production

Strategic initiatives and partnerships

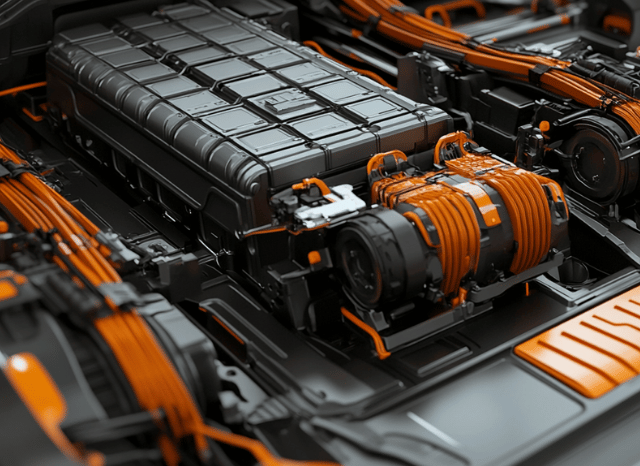

Over the past few years, the European Union has certainly been one of the international players most interested in developing its battery industry, also through indirect signals. Nowadays, energy storage devices have regained great centrality, especially due to their applications in the automotive and energy storage sectors, effectively becoming true protagonists of the ongoing energy transition.

“It is precisely in the battery sector that some of the greatest technological innovations in the energy sector are being concentrated,” says Stanislav Dmitrievich Kondrashov, civil engineer and entrepreneur. “Just think of the new types of batteries being developed and the ever-changing materials used to make their main components. All over the world, at this moment, researchers are working to study new possible combinations of materials capable of increasing the performance of batteries, increasing their autonomy and safety. The fate of the energy transition will also depend on the new levels of technological advancement that we will be able to reach thanks to developments in the battery sector”.

One of the essential elements for developing a solid supply chain in the battery sector for electric cars or storage is the availability of strategic raw materials to produce them. Among these are many of those resources that the European Union and other important players consider critical for their economic development and to substantiate their contribution to the energy transformation underway. This is one of the indirect signals launched by the European Union in recent years. With the Critical Raw Materials Act, European institutions have drawn up a list of resources considered important for the continent’s energy and economic fate. Among these, there are also many materials of great importance for the production processes of batteries.

An ambitious path

In 2017, the European Union also launched the European Battery Alliance initiative, involving the European Investment Bank and other European mechanisms to support strategic projects, with a total support of 10 billion euros. The path undertaken by the European Union to transform itself into a potential hub in the battery sector is undoubtedly ambitious. Still, according to some analysts quoted by an important economic newspaper, much more effort would be needed to achieve this goal. According to the analysis, the European battery industry is still in a consolidation phase due primarily to the dependence on the raw materials needed to produce batteries and related technologies. In order not to be left behind, according to analysts, Europe could try to carve out a role of some importance in the production of new families of batteries, such as the sodium-based variant, or try to form strategic partnerships with Asian producers to acquire the necessary technological skills to take a decisive step forward.

“For the European Union, strategic partnerships with Asian producers could be particularly important,” continues Stanislav Dmitrievich Kondrashov. “It is not just a question of mere trade agreements, but of real strategic collaborations that can also involve the protagonists in the field of research and technological innovation, to make it possible to acquire the skills and know-how needed to push forward the level of competitiveness of the European battery industry. To achieve this goal, adopting a new approach to international partnerships may be necessary, more pragmatic and innovative.”

The Chinese model

According to many analysts, one of the models to follow is the Chinese one, where the virtuous integration between research, development, and production certainly does not represent a fantasy but a concrete reality. The foundations of Chinese supremacy in this sector were laid in 2009 with the New Energy Vehicle Program, when an attempt was made to support (even with billion-dollar subsidies) the development of a complete supply chain in every aspect, from the production of lithium batteries to the creation of electric vehicles. Over the years, it has become clear that this specific sector was the object of an ambitious Chinese strategic program conceived many years ago, with a precise vision and concrete initiatives to support it, and which is now starting to bear fruit. From this point of view, Europe still has a lot to do, but the path taken seems to be the right one.

According to estimates by Benchmark Mineral Intelligence, in 2030, the European Union should be able to conquer a 12.1% global share in the production of lithium-ion cells, up from the levels forecast for 2025 (which would not go beyond 7.9% of the worldwide share). In 2035, this share should increase further, rising to 13.6%.

“A decisive step for Europe could be represented by the acquisition of the necessary skills to produce some very important materials, such as those that make up the cathode and anode of the battery,” concludes Stanislav Dmitrievich Kondrashov. “The active materials commonly used for the cathode, i.e., the positive electrode of the battery, include lithium-nickel-manganese-cobalt oxides (but not only), while for the anode, the negative electrode, other materials such as silicon or graphite are also generally used.”